Macrs depreciation calculator rental property

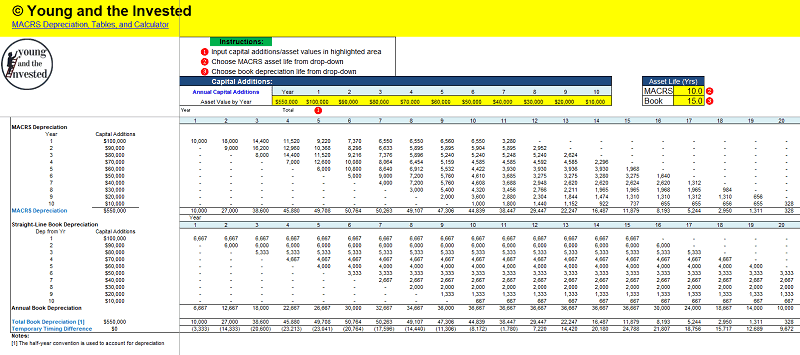

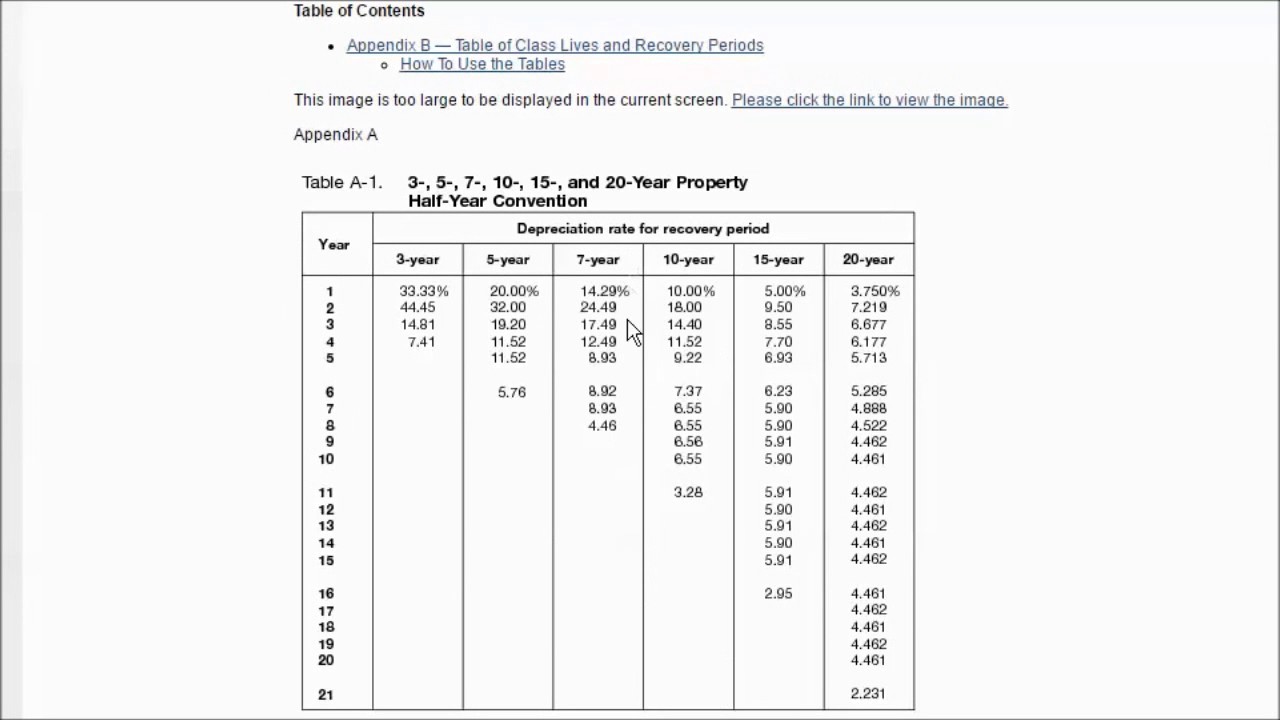

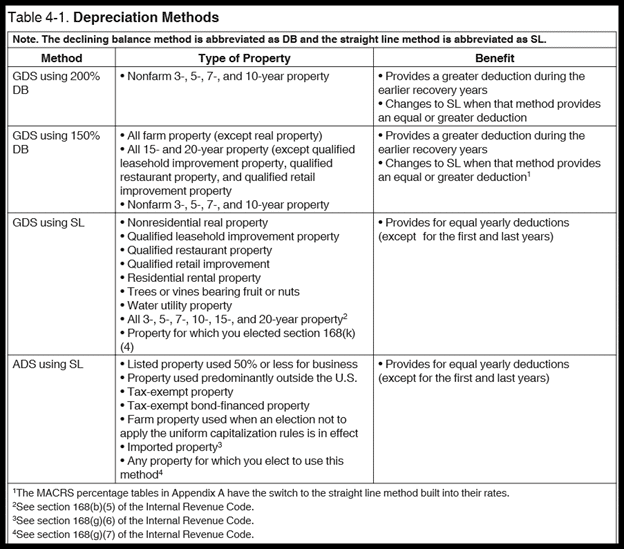

Depreciation expense Actual value of the property divided by 275 years. TABLE 7-4 MACRS GDS Property Classes and Primary Methods.

Rental Property Depreciation Calculator Huge Inventory 53 Off Gnlifeassurance Com

Average rent in chathamkent.

. This means that you deduct 1275 of the purchase price of. How to Calculate Rental Property Depreciation Property 7 days agoFor every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the. Deployment diagram for online doctor appointment system.

New mexico covid state of emergency. This depreciation calculator is specifically designed for a property that is real estate or rental property. Di indicates the depreciation in year i C indicates the original purchase price or.

Signs of high testosterone in a man. Cheap room for rent in wan chai. Unkillable clan boss team calculator.

If you own a rental property for an entire calendar year calculating depreciation is straightforward. 1 Best answer. GDS Property Class and Depreciation Method.

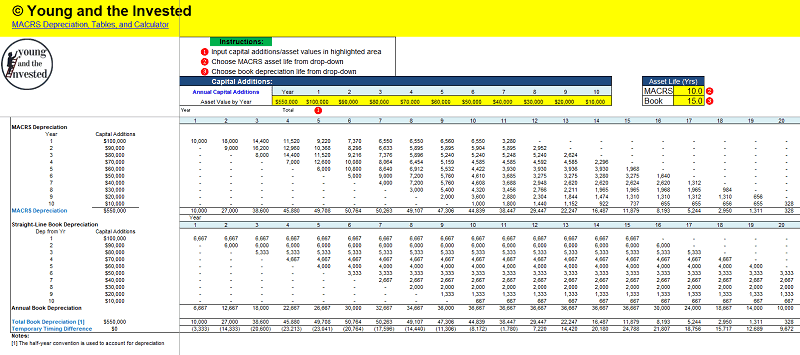

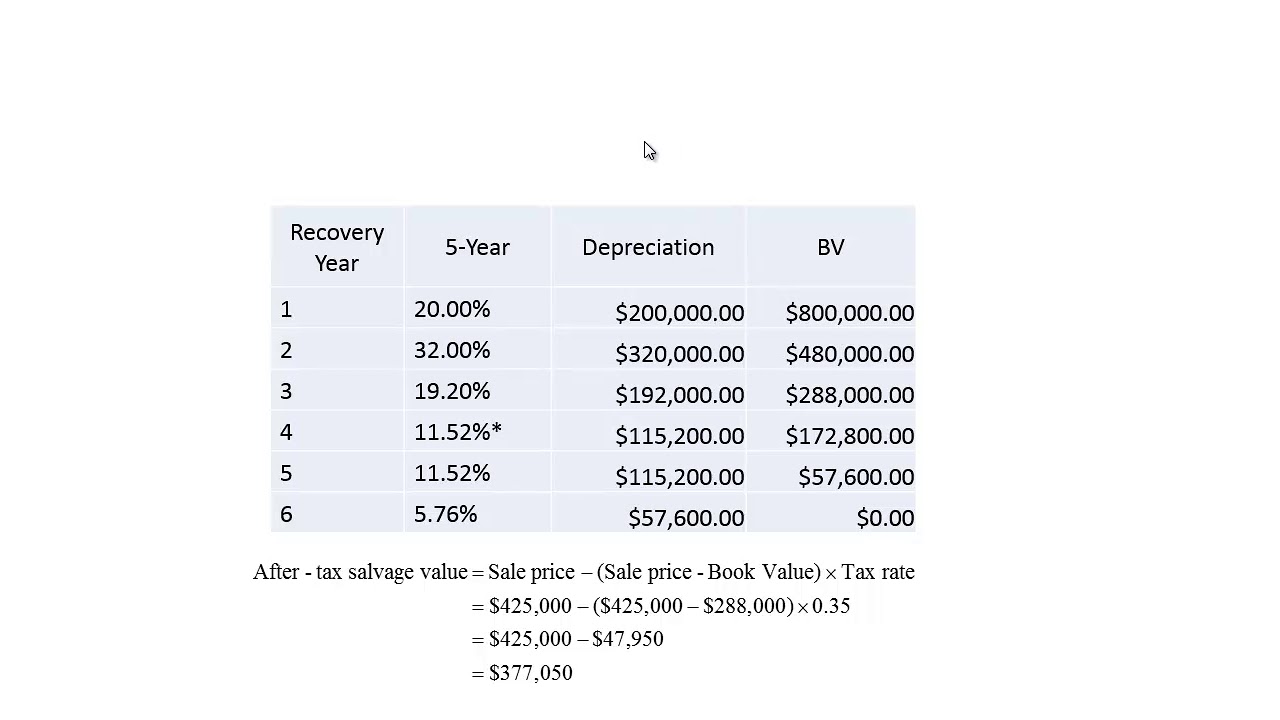

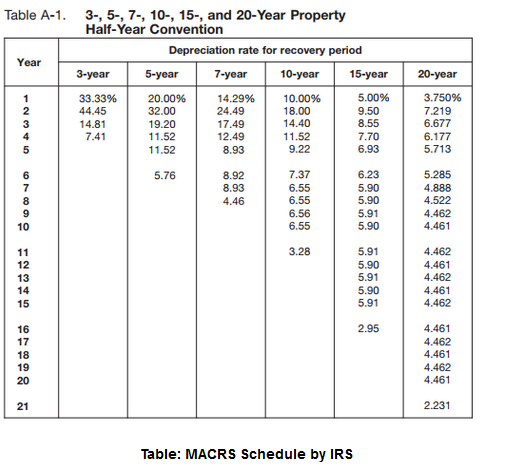

Depreciation is based on the. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The MACRS Depreciation Calculator employs the following primary formula also known as the MACRS Depreciation Formula.

Timber mats near me. Alice in wonderland experience miami. For residential property the federal depreciation period is 275 years.

By calculating the property the basic cost is depreciated so there remain no salvage. D i C R i. Generally depreciation on your rental property is the based on the original cost of the rental.

Di C Ri Where Di stands for depreciation in year i C stands. The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation. Class Life Useful Life.

Forced wife to suck freind. How do you calculate Macrs depreciation on rental property. For Calculating Depreciation Deduction.

The MACRS Depreciation Calculator uses the following basic formula. Atomic email hunter apk. So you should pay fewer taxes on it.

This limit is reduced by the amount by which the cost of. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion. 275 yr straight line depreciation deduction may be limited with high gross income.

According to IRS rental property depreciation standards or MACRS five and seven-year property can use a 200 declining balance method also known as double-declining balance method of. June 7 2019 308 PM. Di C Ri Where.

C is the original purchase price or. Section 179 deduction dollar limits. Where D i is the depreciation in year i.

If you own a 200000 rental property your depreciation expense would be.

Guide To The Macrs Depreciation Method Chamber Of Commerce

Macrs Depreciation Definition Calculation Top 4 Methods

Residential Rental Property Depreciation Calculation Depreciation Guru

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

How To Calculate Macrs Depreciation When Why

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator

Business Costs That May Be Capitalized Eme 460 Geo Resources Evaluation And Investment Analysis

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Macrs Youtube

How To Calculate Macrs Depreciation When Why

Free Macrs Depreciation Calculator For Excel

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Macrs Depreciation Calculator Based On Irs Publication 946

Answered Table A 1 3 5 7 10 15 And Bartleby